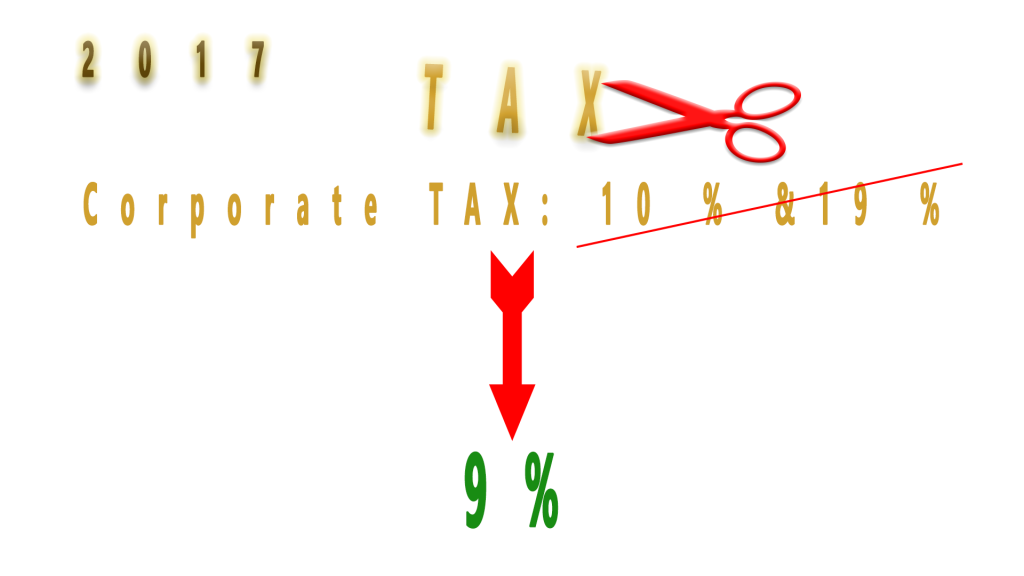

Cutting corporate tax in Hungary in 2017

Without too many comments and forecasts about the corporate tax in Hungary in 2017, there will be serious changes based on the yesterday announcement of the Government. Let us just shortly summarize all the main idea in one picture.

The expectable changes about the corporate tax in Hungary is as below:

This might make a tax heaven from Hungary especially for big companies above the net yearly income of 500 M HUF whose corporate tax in Hungary was 19%. The new tax key will be 9% for all the companies.

This step with some other taxation methods like “KATA” for private entrepreneurs and “KIVA” for companies are all about the fact that Hungary strongly attracts FDI (Foreign Direct Investment). Also those companies who are running here subsidiaries might use Hungary as a tax optimizing place.

Another big winner is going to be the circle of those companies whose taxation discount due date because of the investment expires this year.

In the CEE region Hungary is going to levy the lowest corporate tax: in Slovakia it’s 22%, in Romania it’s 16%, in Servia it’s 15%, in Croatia it’s 20%.

Finally this decision about the corporate tax in Hungary might result an economy whitening result as well. Those who are willing to cheat the tax system will neither chose Hungary because they don’t want pay any taxes either. For those who was in the edge of the grey zone it will worth less to risk because of the decreasing tax percent.

So I hope it is going to be voted as soon as possible!

Just one small note to the end. What I am really waiting is the announcement from the Government about the decreasing VAT!

Business Management Hungary

www.businessmanagementhungary.com