In Hungarian: ÁFA. In English: VAT. In French: TVA. In Russian: НДС. All of them cover the tax called Value Added Tax which is a form of consumption taxes. Also known as General Sales Tax (GST). What else do we know about VAT in Hungary?

The rate of VAT in Hungary now is 27% which is the highest in the World. It might be different in every country, in the EU VAT area it is from 18% to 25%. In Hungary there are three other different VAT keys, 18%, 5% and 0%, depending on the goods or services we are talking about.

But first, get inside the history of VAT. It had been first introduced by the Joint Director of the France Tax Authority, Maurice Lauré in 1954, although in 1918, the German industrialist Dr. Wilhelm von Siemens had already proposed the concept. Initially just large firms were included, but shortly it had been extended to all business sectors. Today in many countries VAT is the most important source of state incomes.

VAT is an indirect tax, not paid to the state by the one who really pays it, the personal end-consumers. Who are by the way are not able to recover VAT but business are. Both on the products and services that they buy in order to produce further goods or services that will be sold to yet another business in the supply chain or directly to the final consumer. In this way, the total tax levied at each stage in the economic chain of supply is a constant fraction of the value added by a business.

The ammount or percent of the VAT in Hungary depends on what we are talking about. The VAT is 0% usually when it comes to social-touched services, folk-arts, some tuitions, ecclesiastical affairs, insurances, loans, selling used immovables, etc. Individual entrepreneurs also can choose to register themselves under the VAT or not, just like companies with specific activities e.g. immovable sellers or lessors. The VAT content is 5% in case of some medical goods, just likes pills, drugs, medical equipments, but also of books, newspapers, some meats. 18% for: milk and dairy products, products made with cereals, flour, or milk and some services. All the rest of the goods and services are levied with 27% of VAT in Hungary.˟

(About starting business in Hungary and taxation you can read and get more information via our website.)

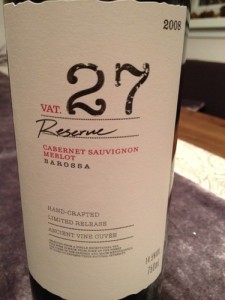

After the raw datas, because I haven’t found a good and matching quote for this topic tiday, a little fun int he end. When the word „VAT” and the number „27” together do not look bad –referring to the 27% of VAT in Hungary. (This is not an advertisement.)

Business Management Hungary

www.businessmanagementhungary.com

published on LinkedIn 03/11/2015 by Business Management Hungary

˟The list is not nearly comprehensive and shows the state on the 03/11/2015. For the entire list check the VAT Act in Hungary: Act CXXVII of 2007 on Value Added Tax.